Look Ahead

Time to be Defensive & Scale Back Risk in 2013

Stocks ended 2012 with the best annual performance since 2009 with the S&P 500 index finishing up 16% on a total return basis. The financial and consumer discretionary components of the S& 500 were the best performers advancing 26% and 22% respectively. Utilities were the worst performers declining nearly 3% while energy producers were the second worst advancing only 2.3%. Equity investors clearly embraced risk in 2012 pushing up economic sensitive stocks while shunning more defensive ones. It is noteworthy that last year’s gains were mostly front-loaded with the first half of 2012 containing the bulk of the advance while the 4th quarter experienced a small decline.

Back in 2012 we predicted an S&P 500 advance of 20% by midyear. We came close as the S&P 500 peaked around an 18.5% (total) return in September. Looking further out into 2013 we think the stock market has to deal with 3 main uncertainties that will likely hold back the S&P 500 to no more than a high single digit return. Political and policy uncertainty, fears about corporate earnings growth, and increased ambiguity about the longevity of the Fed’s quantitative easing program and its eventual exit policy will be high on investors’ agenda in 2013.

Political & Policy Uncertainty:

It is no coincidence that stocks were flat to negative during the fourth quarter of 2012. Be it the ramp into Election Day or the lingering and excruciating fiscal cliff negotiations, the reality is that political uncertainty is not cost free when it comes to stocks. Investors typically lose their appetite for risky assets during these periods and head to the exits. The fact that the fiscal cliff deal reached by Congress only addressed the revenue side of the equation and delayed the spending part to later in the first quarter only heightens policy uncertainty. Even worse, this will coincide with the debt ceiling debate which will also fall during the first quarter. While we think that part 2 of fiscal cliff negotiations will be resolved in a less dramatic manner than part 1, the truth is that a varying severity of spending cuts is coming our way whose impact will be felt beyond the first quarter and that is really what will be the most important outcome of the upcoming policy debate. Based on the first few days of trading in 2013, we do not think that stocks have priced in any of this upcoming reality.

Earnings Growth Uncertainty:

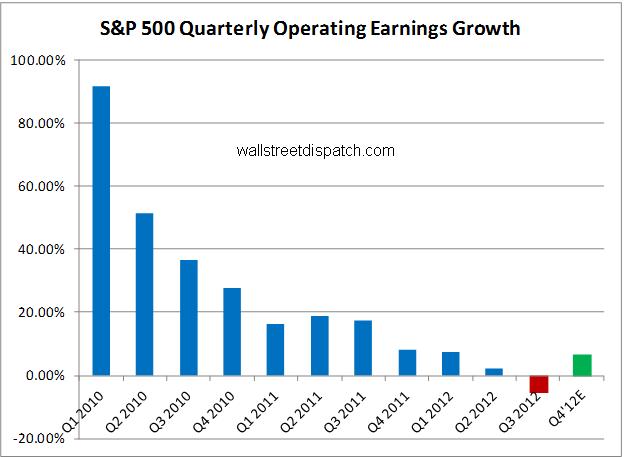

In theory, corporate earnings and the trajectory of earnings growth are two main drivers of stock prices. However, in an era of quantitative easing it is expected that asset prices will deviate from that fundamental theory. When quantitative easing becomes endless in nature and seems to be the norm then it is expected that its effectiveness will wither away with time and exhibit negative returns to scale making earnings growth more relevant again. Looking at the diagram below one can’t miss the steady downward trajectory of operating earnings growth form early on in the economic recovery in 2010 till now. The first quarter in 2010 exhibited the first, and best, post-recession quarterly earnings growth with subsequent quarters exhibiting mostly lower and lower quarterly growth with minor exceptions.

Source: Standard & Poors

Source: Standard & Poors

This does not mean that slow single digit or negative earnings growth will persist in 2013 or beyond. Standard & Poors expects S&P 500 earnings to grow in 2013 by 13.3%, however, we think this is a bit ambitious and more difficult to achieve in the absence of clear catalysts. So far the main catalyst is a bet that the economy will continue to improve with a steady decrease in the unemployment rate. While likely, we expect this outlook to be fraught with risks and very uncertain as we start 2013.

Fed’s Policy Uncertainty

On January 3rd, the FED released the minutes of its December 2012 FOMC meeting that showed some members divided over when to stop its bond purchases. While it is no surprise that the Fed will eventually stop its purchases at some point, this was a reminder that this end-point is coming up soon – but not clear how soon. Regardless when this end-point comes, it is logical to believe, as stated above, that the Fed’s bond purchases will slowly become less effective, everything else being equal, as time goes by. If you subscribe to this logic then assets that benefited from QE will benefit less so going forward and vice versa – everything else being equal being the main caveat here. If the QE trade was to inflate commodities then the 2013 move is to step away form those commodities. If it was to push investors towards riskier assets then scaling back on risk is the move in 2013. I am not advocating to “fight the Fed” but rather to realize that you should at least temper your expectations for the traditional QE-related trades and look elsewhere. Betting with Central banks is a profitable endeavor but that trade in the US is almost exhausted and is closer now to its culmination rather than its inauguration. You should look elsewhere around the globe, particularly in Japan where the Bank of Japan is likely to embark on a more serious version of its own quantitative easing program that is already in place.

Where to put money in 2013

While we expect a high single digit return in the S&P 500 in 2013, it is important to note that the range of returns for the 10 S&P 500 sectors in 2012 was 29%: a low of -3% (Utilities) and a high of 26% (Financials). We do expect less dispersion in the range of performances for the 10 S&P sectors in 2013 but we nevertheless expect that range to be in the high teens. We plan to scale back risk by overweighting defensive sectors such as Utilities, Consumer Staples, and Healthcare while taking a neutral to negative approach to more economically sensitive sectors. We do not anticipate the mass exodus from Treasury bonds to happen in 2013 and think that the status quo in fixed income of 10-year treasury yields of less than 2% to persist for most of 2013. The best trade in fixed income land is NOT to short bonds but rather to bet on an increase in spreads between High Yield and Treasury bonds in the latter half of 2013 – particularly if corporate earnings growth stagnates or disappoints. We are avoiding the QE reflationary trade by staying away from gold but keeping an eye on oil as we see increased likelihood of geopolitical risks impacting oil in 2013.

Tagged Bonds, Gold, NYSE:SPY, NYSE:TNX, NYSE:XLF, Oil, Stocks

If you liked this article please follow us on Twitter and Facebook

Path of Least Resistance for Stocks | Wall Street DispatchMarch 11, 2013 at 1:47 pm

[...] I mentioned in my 2013 outlook piece, stocks have been and will likely continue to be influenced by the actions of the Federal [...]

About Those Great Fourth Quarter Earnings | Wall Street DispatchMarch 12, 2013 at 10:21 am

[...] first quarter to experience a year over year decline in quarterly operating earnings growth. As we noted before, Q3 2012 was the first quarter since Q1 2010 to experience such a decline. Once you realize that [...]