Look Ahead

Next Big Rotation is Out of Stocks into Bonds

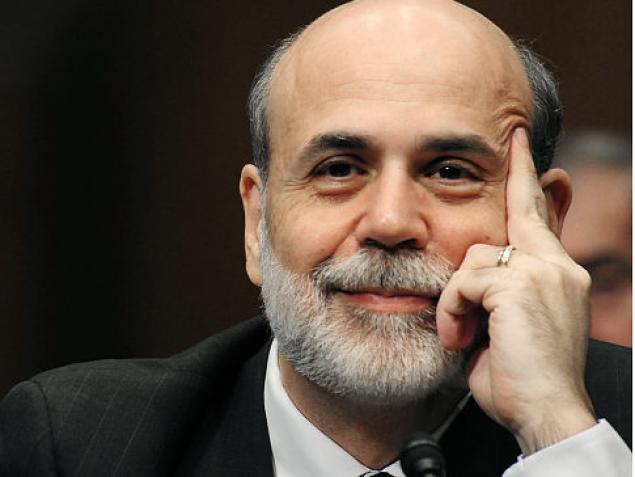

Much has been written about the upcoming reduction of the Federal Reserve’s bond buying program known as Quantitative Easing. There has been a lot of debate on not only when Ben Bernanke will start this much anticipated tapering but also about what impact this will have on the bond and stock markets.

Many commentators believe that as treasury bonds keep falling in price, due to ever increasing interest rates, investors will somehow rush into stocks to escape the drop in the value of their bond holdings. Well, we think quite the opposite is about to happen. The next rotation will be from stocks into bonds and not the other way around. Others interpret rising interest rates as a sign of impending economic growth that will benefit stocks. We are in unprecedented era – interest rates are rising due to prospects of an imminent decrease of stimulus and not because of an abundance of economic growth. Yes, when rates rise in response to good economic growth stocks will do well but if rates rise due to the removal of performance enhancers (QE) then stocks will likely under-perform going forward given current economic and corporate earnings growth prospects.

Based on statements from the Federal Reserve and Ben Bernanke’s latest testimony in front of Congress, I am in the camp of those who believe that the Fed will start reducing its bond buying program in September. In my estimate, it is clear that the Fed is not waiting for robust, or even good, economic reports in Employment or inflation to start its tapering as many believe, but it’s just the lack of terrible economic reports. As it has been often repeated by Fed Chairman Ben Bernanke, one of the main goals of Quantitative Easing was to boost asset prices. With stocks as measured by the S&P 500 rising 16% in 2012 and more than 19% at the end of July 2013 one can’t argue that QE has not achieved its intended goal of boosting asset prices.

7, 10, and 20 year Treasury Bond ETFs have steadily dropped in value since May while Stocks have flat-lined. This phenomenon will reverse soon.

What does this mean?

For Bonds, it is not surprising that as we saw investors front-run the Fed into buying Treasuries before the latest iteration of QE was announced we now are seeing investors exit en masse as the Fed is preparing to reduce its purchases. The 100 basis point increase in 10-year Treasury rates so far this year has not come on the back of robust economic reports as trailing 12-month average monthly non-farm employment growth has been sub 200,000 (189,000 and likely declining) and GDP growth sub 2%. We believe the increase in rates has been purely based on the anticipated reduced demand (purchases) by the Fed and a great deal of this anticipated tapering is probably already priced in the bond market. Risk averse treasury bond investors will reduce maturities, alter makeup of their bond holdings, or go into cash – and not into riskier equities particularly if the increase in yields is triggered by the lack of expected future demand by the Fed rather than healthy economic growth that often leads to monetary tightening and higher interest rates to curb inflation.

For stocks, the impact of the Fed’s tapering can be evaluated based on your answer to the following simple question:

Given that corporate operating earnings for the S&P 500 were up less than 1% in 2012 (yes you read that right) and are up less than 5% for the first half of 2013 according to Standard & Poor’s one can logically conclude that perhaps stocks are a bit ahead of themselves at this point. However, given that stocks are already up so much, the need for further QE is negated based on asset prices alone. Furthermore, if the outlook for GDP and earnings growth in 2014 is cloudy right now then it would make sense to hold back further bond purchases for later when asset prices (read stocks) take a tumble when – or if – this weaker outlook actually materializes. There is no need to keep pumping an already inflated stock market; but it would be better to save some ammunition for later when investor’s 401ks really need it – now they don’t. History will likely judge quantitative easing as probably the most effective tool ever used to boost asset prices in the US. Keeping this tool effective requires that you stop using it when asset prices are already goosed up. With the S&P 500 up as much as 19% one can argue that the Fed can raise a mission accomplished banner for 2013 and save further QE ammo for later.

Where to invest for the rest of 2013

As mentioned earlier, with the S&P 500 index up 19% at its highest point so far in 2013, the risks going forward are likely to the downside. As interest rates increase, we are likely to see more income focused equity investors attracted to bonds rather than the other way around. Taking profits and reducing equity exposure is probably the conservative way to go. For existing equity exposure, overweight positions in healthcare and consumer staples stocks are probably the safest places to be in. As for bonds, if you have not reduced maturities and bond duration in your portfolio then you have already suffered most of the losses that you are likely to suffer in 2013. I expect 10-year Treasury bond yields to stabilize around the 3% to 3.20% area and actually start declining again as inflows from equities rush into the safety of treasury bonds if stocks start selling off. The areas where it is probably prudent to increase allocations to is the US dollar at this time. As interest rates increase and as inflation remains under control, the US dollar will likely appreciate against other major currencies. In addition, any added volatility in the markets will be dollar positive as well. In tandem with increased US dollar exposure, and as a natural hedge, an increased allocation to European equities based on valuation is also warranted at these levels.

Bernanke’s Legacy

Bernanke’s legacy will be that he not only was the Fed Chairman who restored investor’s 401Ks – or 201Ks as they were referred to in 2009 – back to their original 401K values in only 4 years – quite a feat after arguably the worst financial crisis since the great depression – but he left his position while leaving the same effective tools he utilized to be used just as effectively by his successor.

If you liked this article please follow us on Twitter and Facebook