Look Ahead

Fiscal Cliff Impact on Investors

Much has been written about the impending “Fiscal Cliff” whereby come January 1 spending cuts and tax hikes will go in effect. However, not enough clear analysis has been written about the impact on financial markets for the rest of this year and in 2013 if there isn’t a deal struck between the White House and Congress.

Much has been written about the impending “Fiscal Cliff” whereby come January 1 spending cuts and tax hikes will go in effect. However, not enough clear analysis has been written about the impact on financial markets for the rest of this year and in 2013 if there isn’t a deal struck between the White House and Congress.

I will attempt to describe the impact on the markets if no deal is reached this year and how will this impact investors and the main asset classes that will suffer or benefit from this as a result.

Markets

When it comes to financial markets the impact of the fiscal cliff will be felt the most in capital gains taxes and dividend tax rates. This will, in turn, impact some stocks for sure as well as some bonds – particularly municipal bonds.

Capital Gains Taxes: Currently taxes on profits from stocks are a maximum of your current income tax rate (currently a maximum of 35%) if you held the stock for less than a year (short term capital gains) and 15% if you held the stock for at least one year (long term capital gains). However, the top income tax rate will automatically jump to %39.6 on January 1 effectively becoming the rate for short term capital gains. Also, long term capital gains rates will automatically jump from their current 15% to 20%. So clearly if there is no fiscal cliff deal you will have to pay more taxes on your gains from stocks whether your gains are long or short term in nature. For short term gains the impact is an increase from %35 to %39.6 or roughly a 13% increase. For long term gains, your baseline scenario is an increase from 15% to 20% or a whopping 33% increase. It is expected that tax rates for long term capital gains taxes will likely shoot up over 20% in a potential compromise. So if you had $100,000 in long term capital gains this year you will pay $15,000 in taxes if you sold your stock by December 31, 2012 and at least $20,000 if you sold them on January 2nd 2013. Keep in mind that you can sell your stock on December 31 and buy it again on January 2nd without any penalty or coming foul of wash-sale rules. This increase in long term gains taxes will have a strong impact on stocks that have done extremely well this year. Look at the top performers this year and you will see a list of stocks that will likely experience increased volume and volatility in December.

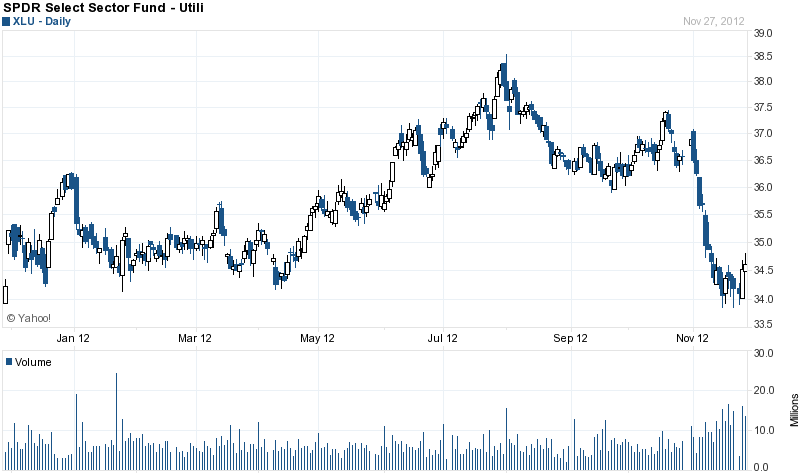

Dividends: Similar to those on Capital gains, tax rates on dividends are currently expected to rise next year to a maximum of %39.6 from their current maximum level of 15%. The magnitude of the increase is significant and amounts to a 164% jump. This is a material increase if you are in the highest tax bracket. Without going into advanced financial valuations theory for stocks and securities but a stock’s dividend is an important part of any valuation formula that attempts to price a stock. Most impacted are those stocks that currently have a high dividend yield. Everything else being equal, high yielding stocks on December 31, 2012 are worth less on January 2nd, 2013 simply because the dividend component of their stock valuation will be worth less because you will keep less of it. This is a fact and not an opinion. It is not a coincidence that 1) more companies are announcing special dividends or speeding up their dividend payouts making them in 2012 versus next year and 2) the worst performing sector in the S&P 500 in November is the dividend-rich Utilities sector which is down nearly 7% in November versus a 1% decrease in the S&P 500 (up to November 27). Everything else being equal, it is a safe expectation that low growth and high yielding dividend stocks will be under pressure until year-end but may likely be a good bargain in January.

Utilities Stocks as measured by Utilities Select Sector SPDR XLU ETF have tanked in November

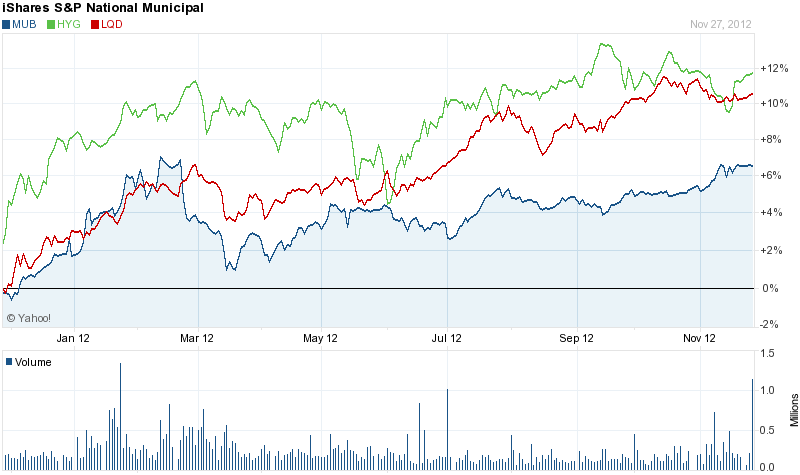

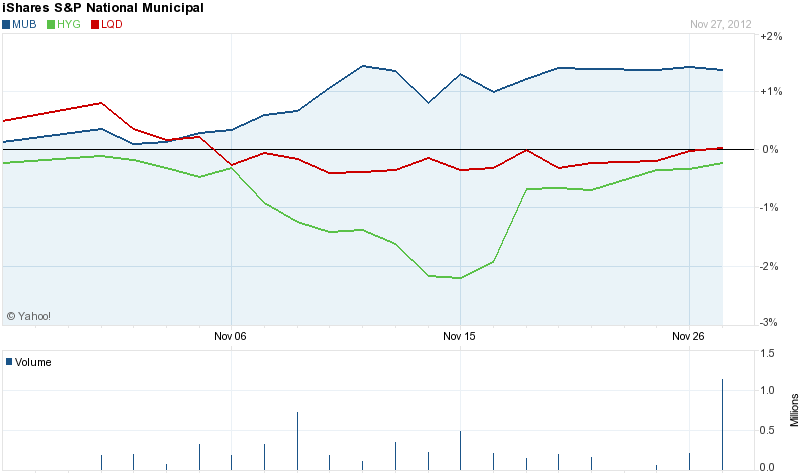

Municipal Bonds: Munis are tax free bonds that are exempt from federal income taxes and may be exempt from State and local taxes in many instances. If their tax exemption is maintained, they will be more valuable next year if personal income taxes go up as expected. The tax free income earned from Municipal bonds will be worth more next year compared interest gained from corporate bonds for example. Again, it is not a coincidence that while year-to-date high yield and high grade corporate bonds have been outperforming municipal bonds, that trend has reversed over the last three and one months time periods as measured by the MUB (iShares S&P National AMT-Free Muni Bond), LQD (iShares iBoxx $ Investment Grade Corp Bond) , and HYG (iShares iBoxx $ High Yield Corporate Bond) ETFs. I believe this is a good indicator of investor ‘s preference going forward till year-end.

Muni Bonds are in Blue below and have underperformed Corporate Bonds year-to-date

Muni Bonds are in Blue below and have outperformed Corporate Bonds in November

Bottom Line

Given the above it would be a good idea to sell your stocks with the most gains this year as the expected increase in capital gains taxes will have a real impact on your tax bill. You can wait till end of December to sell your winners and buy them back early next year. As for high yielding dividend stocks it may be too late to sell them but it may be a good idea to wait till the end of the year or early in January to buy any as they may go down a bit more. In the meantime it will probably be a better idea to consider municipal bonds if you are considering buying any income oriented investments.

Cliff Photo Credit

Tagged Fiscal Cliff 2012, NYSE:HYG, NYSE:LQD, NYSE:MUB, NYSE:XLU

If you liked this article please follow us on Twitter and Facebook

How the Fiscal Cliff will be resolved and who has the upper hand in the negotiations | Wall Street DispatchNovember 30, 2012 at 11:44 am

[...] See my other article on Fiscal Cliff impact on Stocks and Bonds [...]